student loan debt relief tax credit application 2021

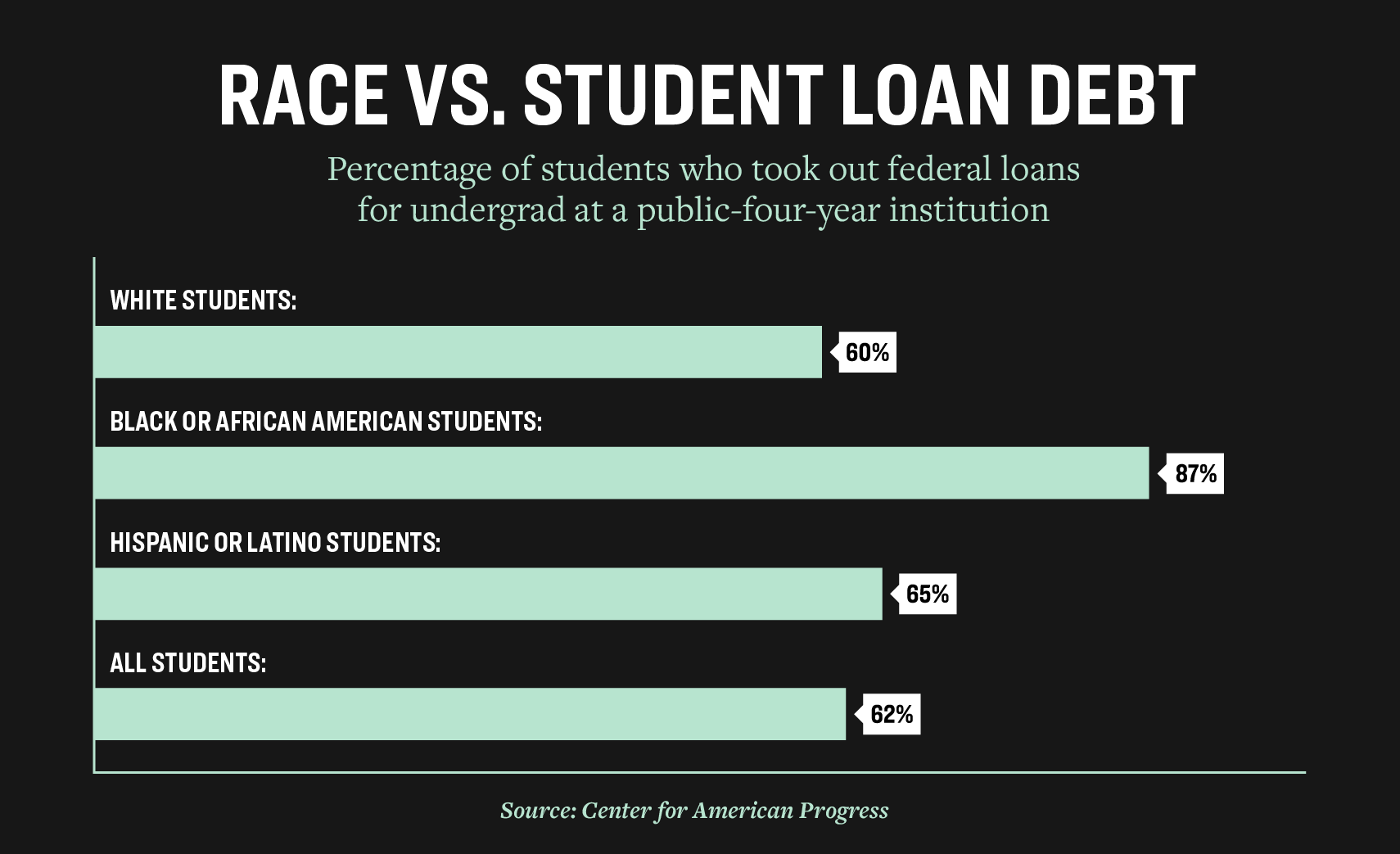

The skyrocketing cumulative federal student loan debt16 trillion and rising for more than 45 million borrowersis a significant burden on Americas middle class. 115000 borrowers were given 11 billion in loan cancellations in August 2021 and another 208000 students had 39 billion in loans canceled.

The Case Against Student Loan Forgiveness

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

. For tax financial debt relief CuraDebt has an incredibly professional group resolving tax financial obligation issues such as audit defense complicated resolutions offers in concession deposit. Reposted from the Comptroller of Maryland August 23 2022 news article. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

Millions of borrowers with federal student loan debt need to line up their paperwork and circle Nov. It was established in 2000 and is a part of the. Millions of federal student loan borrowers will soon see up to 20000 of their debt wiped away thanks to a new plan recently announced by President Joe Biden.

ITT Technical Institute. 1 day agoEligible people have until Sept. Under Maryland law the.

Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Student loan debt relief is available to those whose adjusted gross income AGI from either the 2020 or 2021 tax year was under 125000. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Ad Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. At one point the speculation was that federal student loan debt forgiveness might apply only to borrowers earning less than 150000 if single or 300000 for married couples. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000 Marylanders.

CuraDebt is a company that provides debt relief from Hollywood Florida. Recipients of the Student Loan Debt Relief Tax Credit have two options for debt repayment. Fillablechangeable documents such as Word or Excel are not.

Make a one-time payment for the amount of tax credit to lender. More than 9155 Marylanders. The Student Loan Debt Relief Tax Credit application is due September 15.

2 days agoThe Student Loan Debt Relief Tax Credit application is due soon. About the Company Student Loan Debt Relief Tax Credit Application. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application.

The following documents are required to be included with your Student Loan Debt Relief Tax Credit Application. When setting up your online account do not enter a temporary email address such as a workplace or college. Complete the Student Loan Debt Relief Tax Credit application.

Maryland Adjusted Gross Income. Have at least 5000 in outstanding student loan debt upon applying for the tax credit. CuraDebt is a debt relief company from Hollywood Florida.

You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. Have the debt be in their the Taxpayers name.

Married couples who file taxes. August 23 2022 Comptroller Peter Franchot urges eligible Marylanders to. Apply For Tax Forgiveness and get help through the process.

About the Company Student Loan Debt Relief Tax Credit Application 2021. The credits goal is to aid residents of the Chesapeake Bay state who took out. Student loan debt relief is available to those whose adjusted gross income AGI from either the 2020 or 2021 tax year was under 125000.

Claim Maryland residency for the 2021 tax year. 15 on the calendar or add an alert to their smartphone to make. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit.

In 2021 approximately 9000 Maryland residents received a. For unsafe financial obligations such as credit cards individual car loans particular personal trainee loans or other similar a financial debt relief program might offer you the service you. It was founded in 2000 and has since become a.

Married couples who file taxes jointly and anyone.

Student Loan Forgiveness In Canada Loans Canada

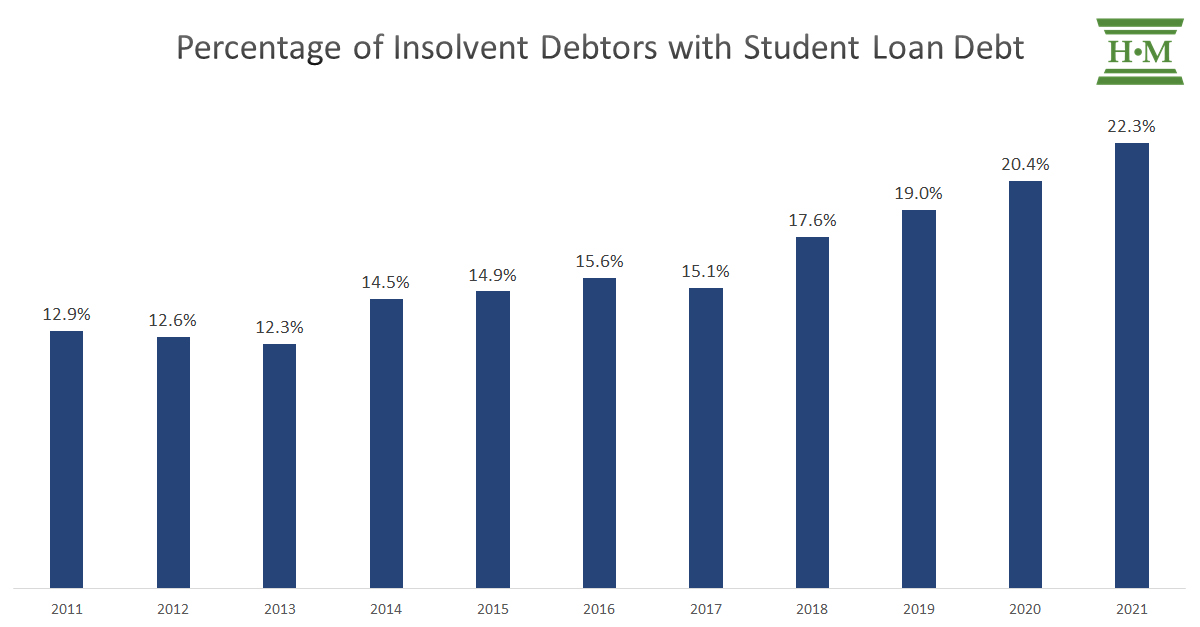

2021 Joe Debtor Bankruptcy Study Who Files Bankruptcy Why Hoyes Michalos

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

Student Loans And Bankruptcy Consumer Proposal Laws 7 Year Rule

Student Loan Forgiveness In Canada Loans Canada

Student Loan Forgiveness In Canada Loans Canada

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

![]()

Student Loan Forgiveness In Canada Loans Canada

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Due Dates For Tds Itr For The Month Of November 2021 Tax Deducted At Source Due Date Make Money From Home

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Student Debt Relief Am I Eligible For Loan Forgiveness How Much Is Canceled How Do I Apply Cnet

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Good Debt Vs Bad Debt Bad Debt Credit Card Debt Relief Consolidate Credit Card Debt

My Plan To Cancel Student Loan Debt On Day One Of My Presidency Elizabeth Warren

/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)