operating cash flow ratio ideal

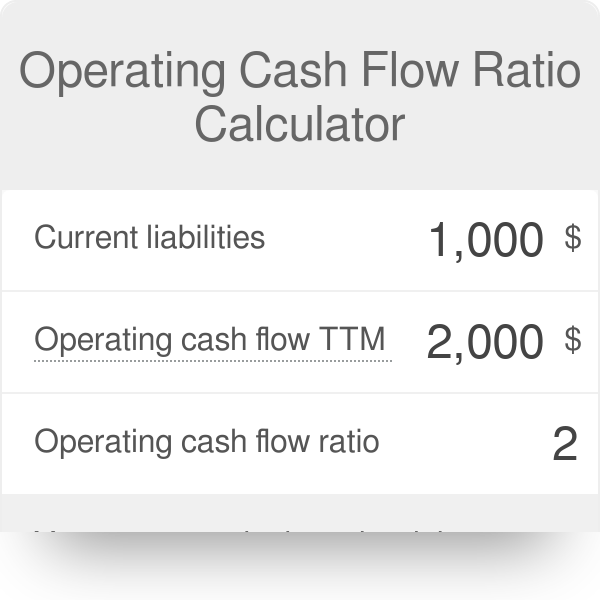

You can work out the operating cash flow ratio like so. Essentially Company A can cover their current liabilities 208x over.

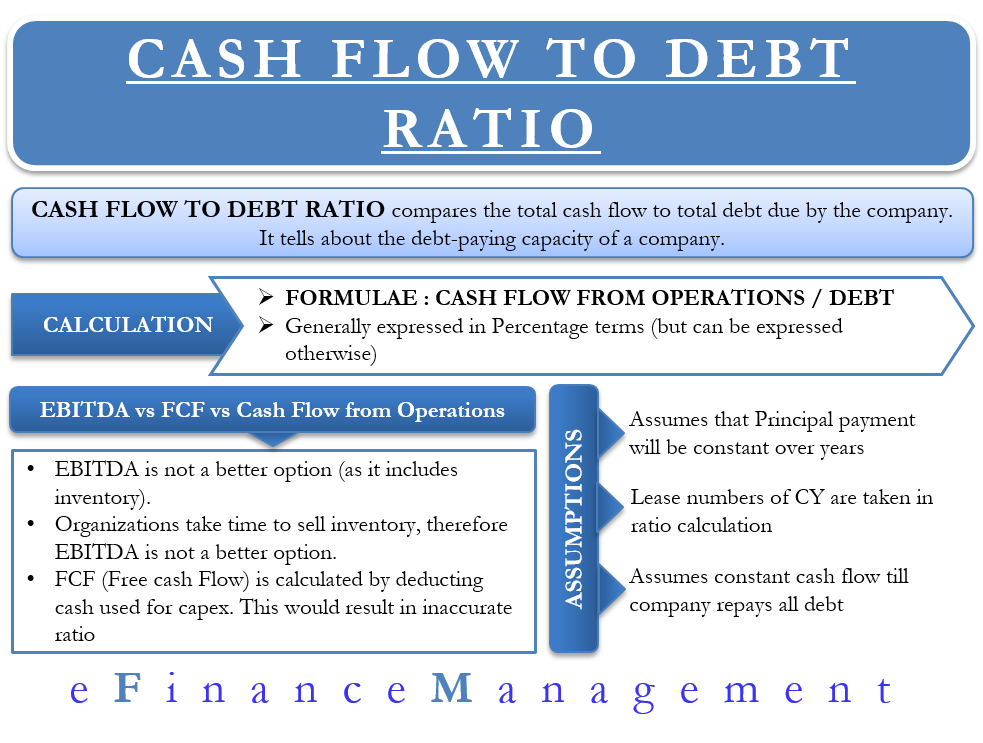

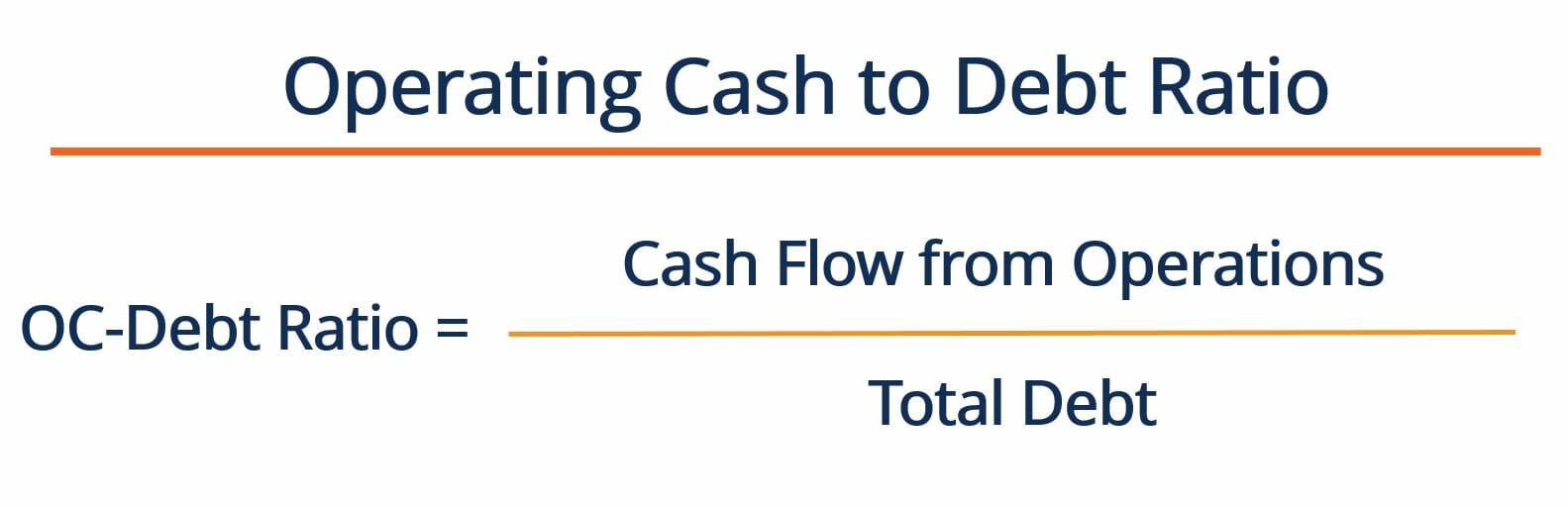

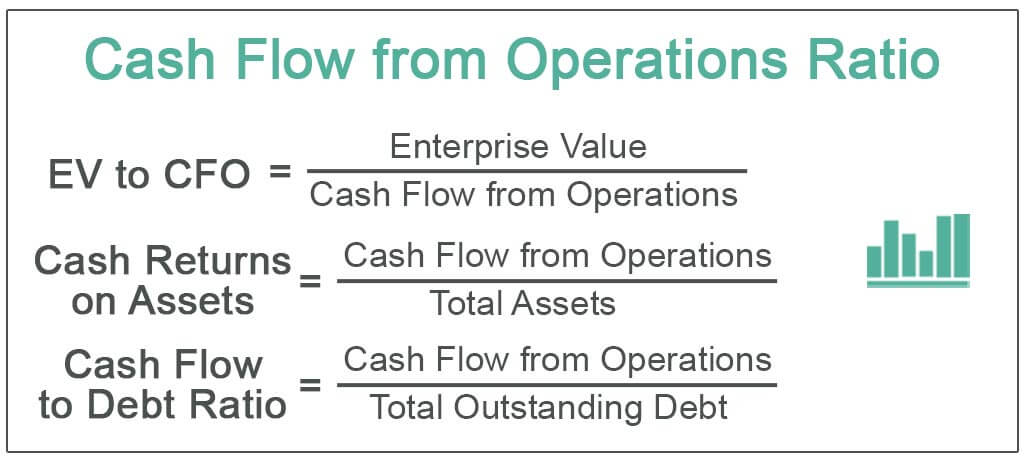

Cash Flow To Debt Ratio Meaning Importance Calculation

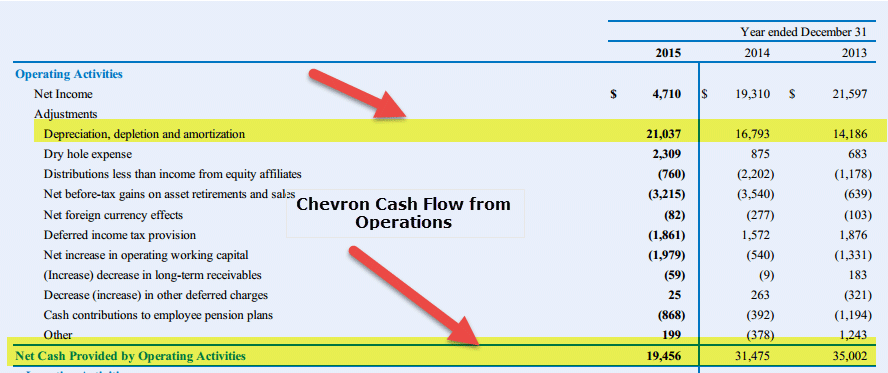

It is also sometimes described as cash flows from operating activities in the.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

. It should be considered together with other. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100. The ideal ratio is close to one.

500000 100000. A cash ratio of 02 means that each rupee in debt owed by the company in the next year will be received in cash. The cash flow from operations ratio is a measure of how much cash a company has on hand to cover its current liabilities.

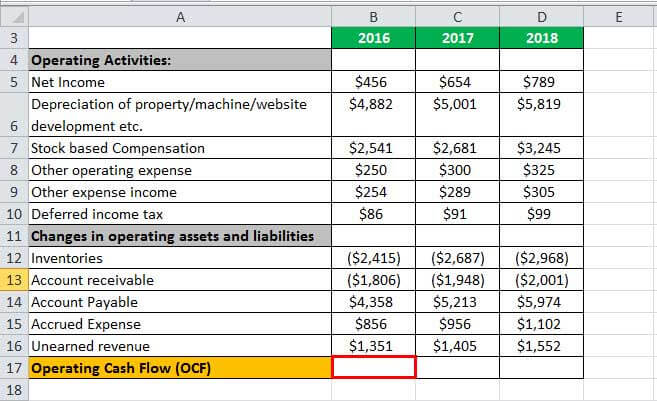

Operating cash flowalso referred to. If it is higher the company generates more cash than it needs to pay off current liabilities. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations.

However there is a crucial difference between the two measures. A ratio of more than one indicates good financial health as it implies cash flow that is more than adequate to pay short-term financial obligations. Ideally a good cash turnover ratio is one that gets smaller depending on the company.

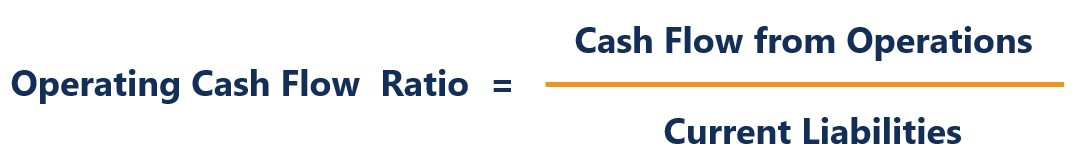

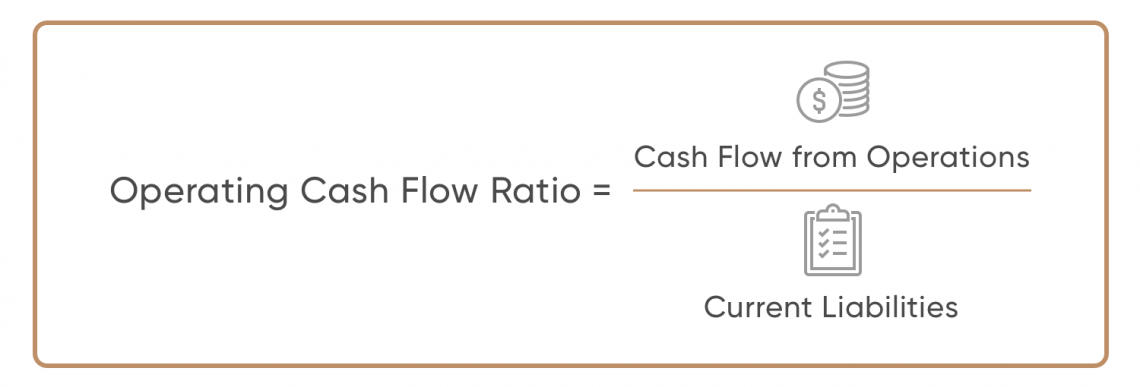

The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. When a ratio less than 10 is used your company spends more money on operations than it makes. However they have current liabilities of 120000.

The formula for this ratio is simple. So a ratio of 1 above is within the desirable range. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100 The figure for operating cash flows can be found in the statement of cash flows.

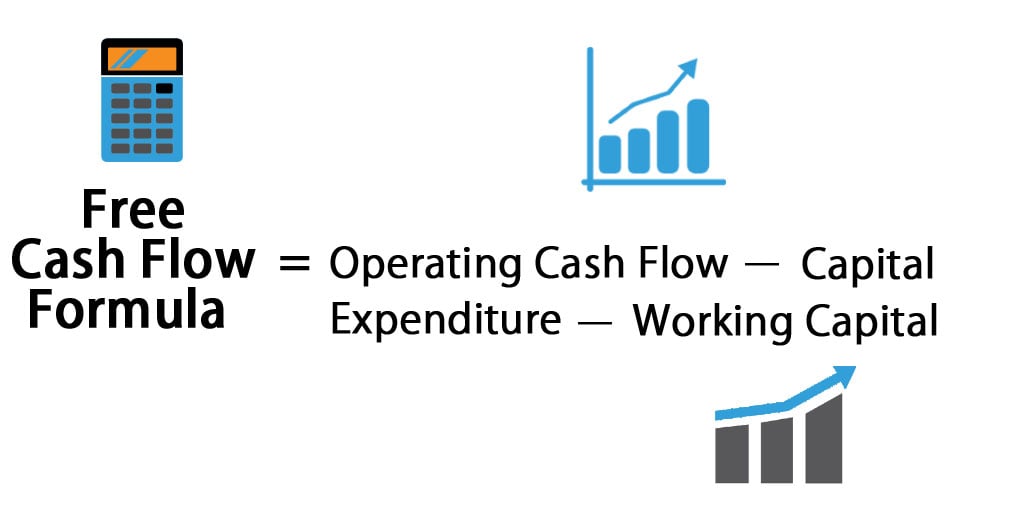

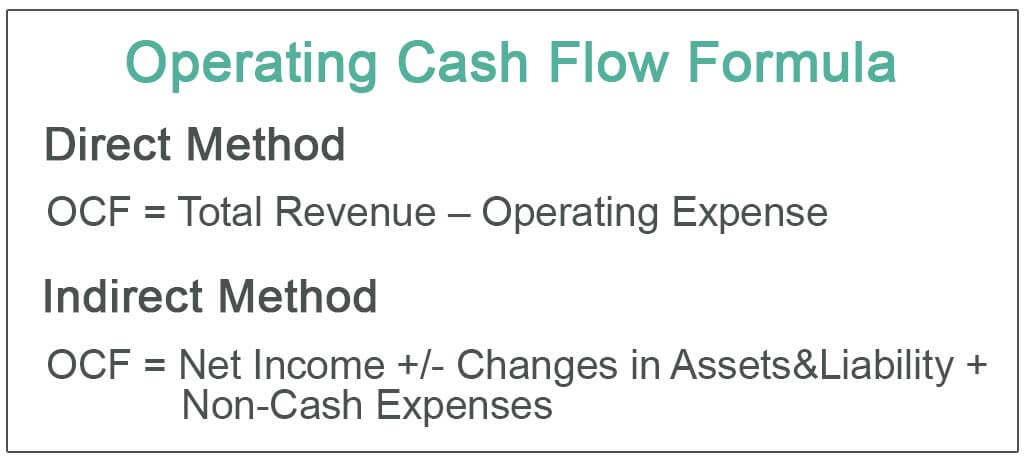

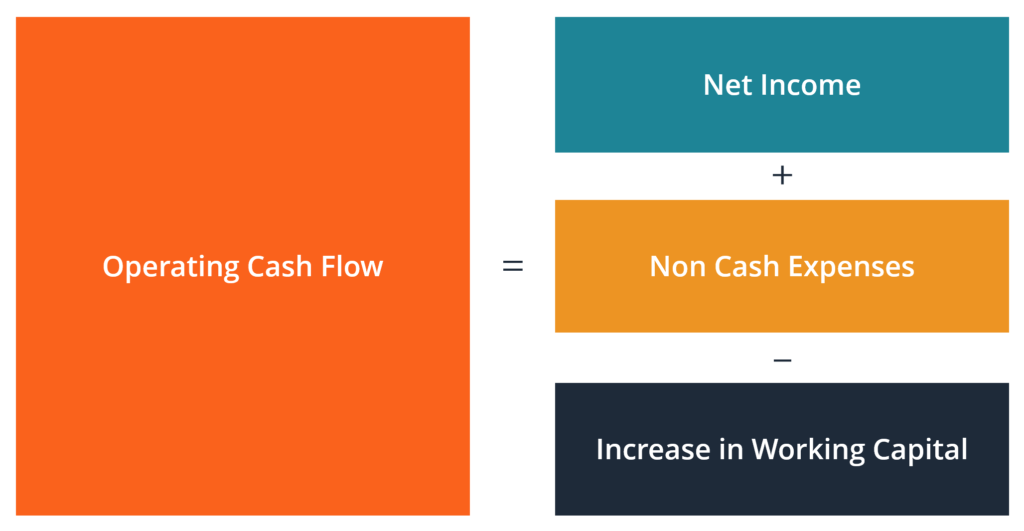

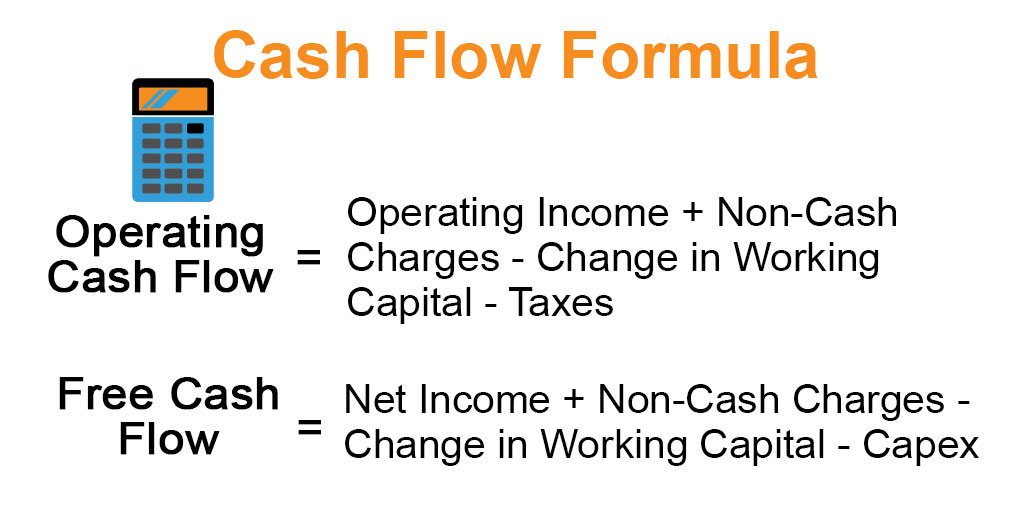

Alternatively the formula for cash flow from operations is equal to net income non-cash expenses changes in working capital. The cash turnover ratio shows you how many times the company can make a complete cycle of cash flow. However we do not use the most liquid money and assets currently held by the company.

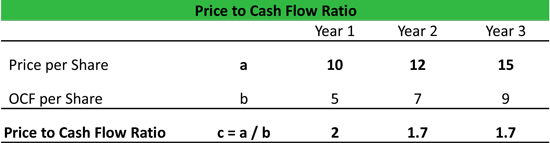

Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance sheet. A lower price to cash flow is ideal demonstrating that share value will most likely increase. Operating Cash Ratio Formula and Understanding.

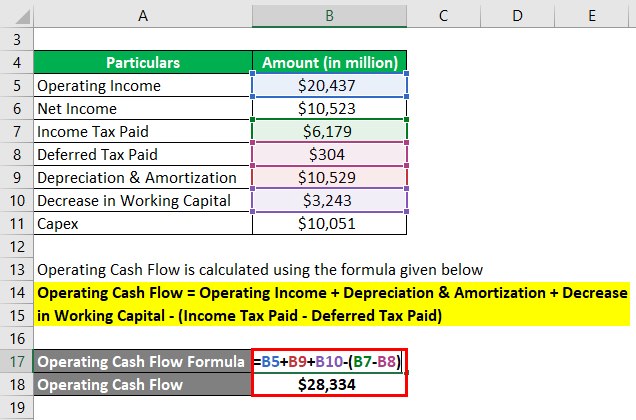

Lets consider the example of an automaker with the following financials. Far and above the most valuable liquidity ratio is the operating cash ratio. The operating cash flow ratio assumes that cash flows from operations will be the source of funds for those payments while the current.

So a ratio of 1 above is within the desirable range. The ideal cash flow ratio is 025. Cash flow from operations refers to the magnitude of cash flows that the business generated from operations during the accounting period.

On the other hand. Operating Cash Flow Margin. This also means that although the stock.

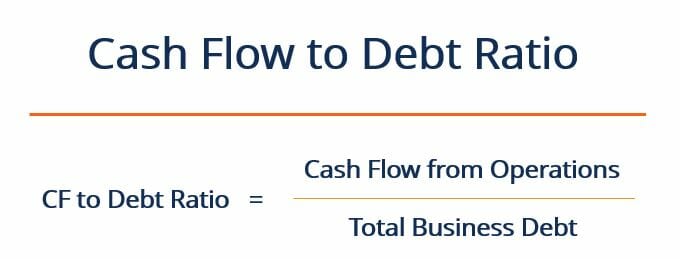

Thus investors and analysts typically prefer higher operating cash flow ratios. A cash flow coverage ratio of 138 means the companys operating cash flow is 138 times more than its total. The operating cash flow can be found on the.

Cash returns on assets cash flow from operations Total assets. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. 250000 120000 208.

Although there is no one-size-fits-all ideal ratio for every company out there as a general rule the higher the Operating Cash Flow Margin the better. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. The formula to calculate the ratio is as follows.

The operating cash flow ratio is a measure of a companys liquidity. This ratio can be calculated from the following formula. However there are no ideal cash turnover ratios This is because different companies have different operating styles.

A working cash flow ratio of roughly 11 is ideal implying a profit of 10p for every 1 you earn. This may signal a need for more capital. Instead we use the money made in a year.

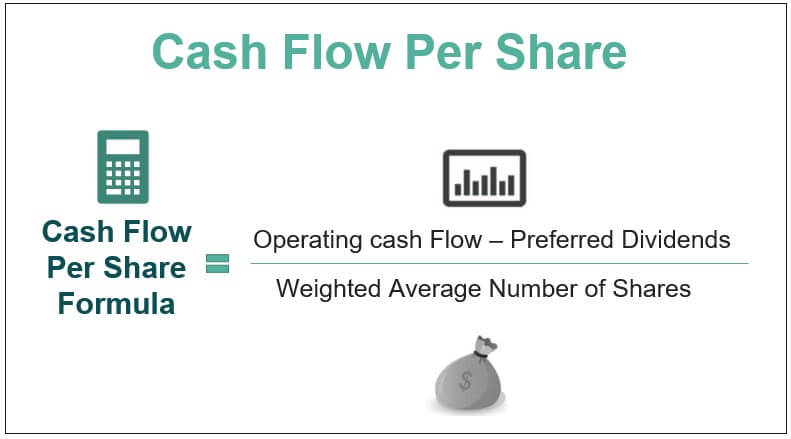

This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made. It measures the amount of operating cash flow generated per share of stock. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula.

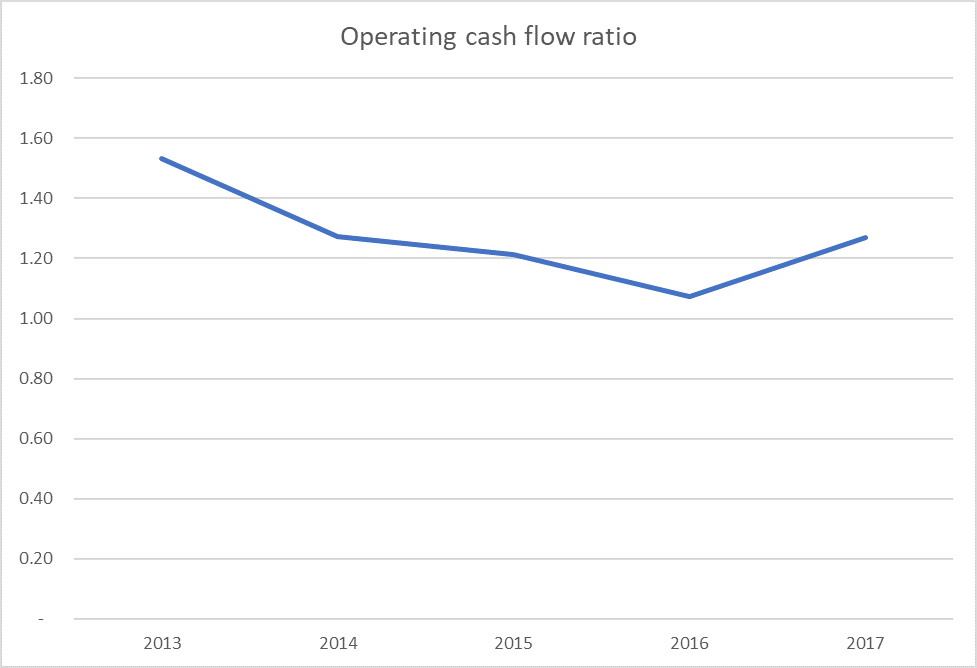

Operating Cash Flow. What Does Cash Ratio 02 Mean. If this ratio increases over time thats an indication that your business is getting better and better at converting.

Here is the formula for calculating the operating cash flow ratio. This ratio is similar to the cash ratio. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. Operating cash flow ratio is an important measure of a companys liquidity ie. The ideal ratio would be 11 which would mean that the business is in good standing.

Operating Cash Flow Ratio. It means that the automaker generates a cash flow of 5 on every 1 of its assets. The calculation result from the operating cash flow ratio is usually expressed as a financial indicator.

High cash flow from operations ratio indicates better liquidity position of the firm. The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations. A higher ratio is better.

CFO CL OCF Ratio. The companys operating cash flow ratio or Operating Cash Flow Ratio is a ratio that shows how well a company can pay off its current. A Guide to Liquidity With Definitions.

Its primary element the numerator in this formula is. Operating Cash Flow Margin Cash Flow from Operations Net Sales. The figure for operating cash flows can be found in the statement of cash flows.

Example of Cash Returns on Asset Ratio. In this case the retail company would have a cash flow coverage ratio of 138. This indicator is discussed in financial monetary terms.

Cash flow from operations average current liabilities operating cash flow ratio. Its ability to pay off short-term financial obligations. Cash Returns on Asset Ratio 5.

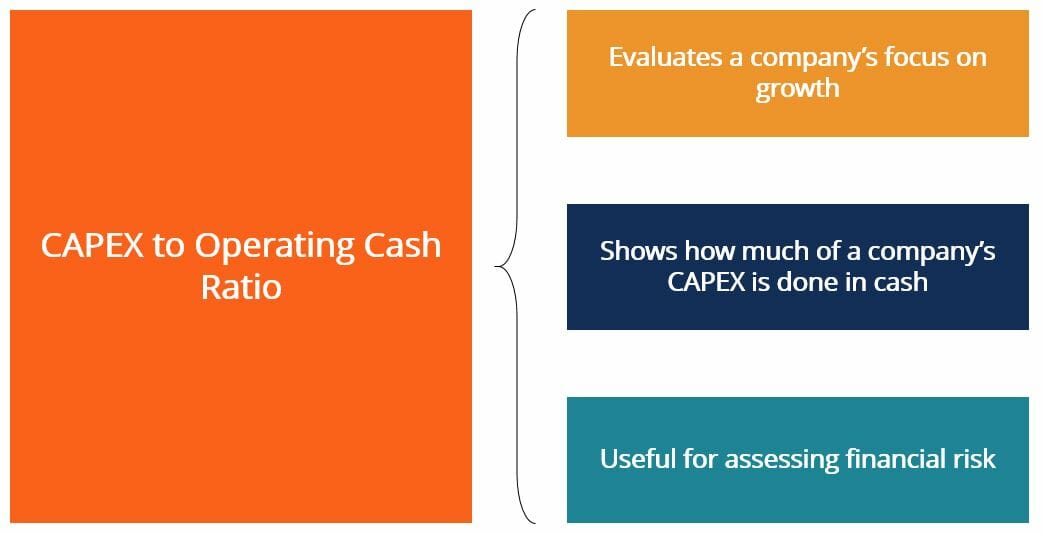

The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. What does a cash turnover ratio show you. The CAPEX to Operating Cash Ratio is calculated by dividing a companys cash flow from operations by its capital expenditures.

The operating cash flow. This means that Company A earns 208 from operating activities per every 1 of current liabilities. High Low Operating Cash Flow Ratio.

Operating cash flow ratio. The formula for calculating the operating cash flow ratio is as follows.

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Ratio Definition Formula Example

Cash Flow Per Share Formula Example How To Calculate

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Formula Calculation With Examples

Cash Flow From Operations Ratio Formula Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Ratios Calculator Double Entry Bookkeeping

Operating Cash Flow Ratio Calculator

Operating Cash Flow Definition Formula And Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Ratio Definition And Meaning Capital Com