vermont sales tax exemptions

Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax Counties and cities can charge an additional local sales tax of up to 1 for a. Taxation and Finance Chapter 233.

What Is Sales Tax A Complete Guide Taxjar

Take the burden of sales tax compliance off your plate with help from Avalara AvaTax.

. Sales tax exemption can only be. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. We offer a broad product selection value added services manufacturing solutions.

53 rows Division of Finance Administration Sales Use Tax Exemptions by State Present. The Vermont Sales Tax Exempt Certificate For Manufacturing Publishing Research Development or Packaging is utilized when purchasing items used in the operation of the. Exemptions The following is a list of conditions that will allow you to register your vehicle exempt from payment of the Vermont Purchase and Use Tax.

Here are the special category rates for Vermont. Ad New State Sales Tax Registration. Page 2 of 4 ST-121 111 Part 2 Services exempt from tax exempt from all state and local sales and use taxes Enter Certificate of Authority number here if applicable H.

Vermont Sales Tax Exemption Certificate information registration support. Agricultural machinery and equipment used 75 percent of the time or more. Restaurant meals may also have a special sales tax rate.

Tax Bulletin 7-11. 9741 9741. Meals and Rooms Tax see p.

Ad The Semiconductor Lifecycle Solution the worlds largest source of semiconductors. SALES AND USE TAX Subchapter 002. Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in.

19242-3 Meals and Rooms Tax TB-13. Vermont sales tax exemptions Vermont has several tax exemptions on sales of tangible personal property including. A vehicle owned or leased by the.

The Vermont Statutes Online Title 32. Clothing EXEMPT Groceries EXEMPT Prepared Food 9 Prescription Drugs EXEMPT. Vermont CVR 10-060-023 Reg.

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

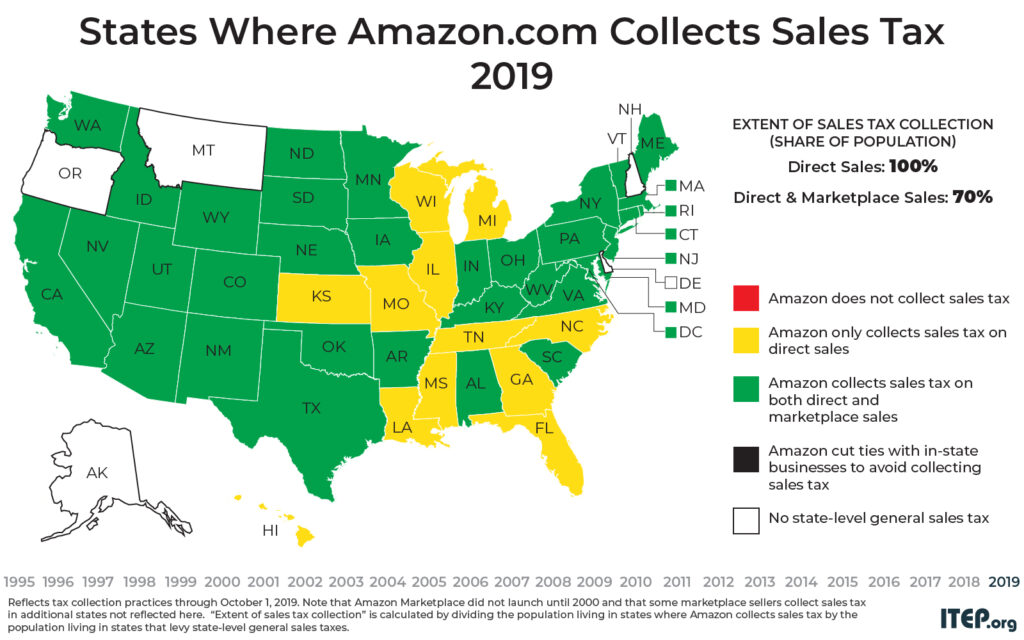

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Sales Tax By State Is Saas Taxable Taxjar

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Map State Sales Taxes And Clothing Exemptions Tax Foundation

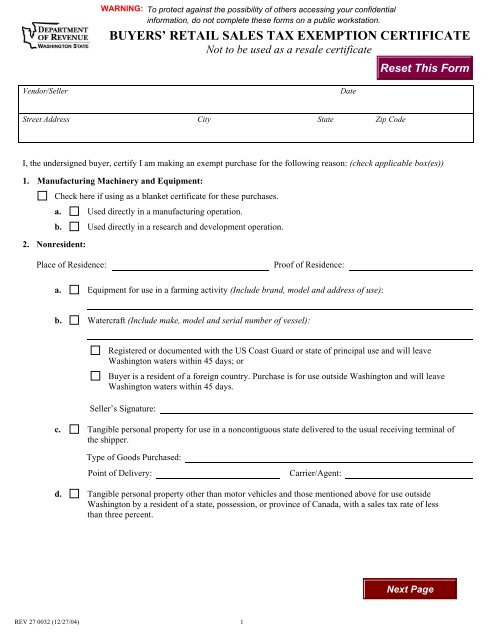

Buyers Retail Sales Tax Exemption Certificate

State By State Guide To Taxes On Retirees Retirement Tax States

States Without Sales Tax Article

Sales Tax Holidays Politically Expedient But Poor Tax Policy

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Taxes In The United States Wikiwand

States Without Sales Tax Article

Nevada Sales Tax Small Business Guide Truic

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management